The holiday season is filled with exciting, trendy toys and gifts, but what if this year, you could give a gift that can grow in value over time? Choosing something meaningful, especially one that supports your child’s future, can be a powerful way to show love that lasts.

Here’s a guide to meaningful gifts that can go well beyond the thrill of unwrapping.

1. Opening and Gifting to an Edvest 529 College Savings Plan account

An Edvest 529 College Savings Plan account can make for a truly impactful, future-focused gift. This Wisconsin-sponsored 529 investment plan is designed to make it easy for families to save for college with triple tax benefits, flexibility, and a range of investment options. It’s a gift that can ease future financial burdens, like student loans, and shows your commitment to your child’s dreams.

Contributions to an Edvest 529 account can grow tax-deferred, and withdrawals are 100% tax-free when used for qualified education expenses, like college tuition or room and board. Funds in Edvest 529 can be used nationwide for universities, apprenticeships registered and certified by the Secretary of Labor under the National Apprenticeship Act, student loan repayments subject to a lifetime limit of $10,0000 per individual, and even K-12 tuition up to $10,000 per year.

How to Get Started: Open an Edvest 529 account online here and set up a one-time gift or recurring contribution. You can also share your account details through Edvest’s gifting platform, Ugift®, allowing friends and family to contribute. Use this opportunity to start a conversation with your child about their future goals and aspirations, explaining that this is a gift for their future education.

2. Personalized Book Collection

Encouraging a love of reading can provide lifelong benefits. Curate a collection of high-quality, age-appropriate books with messages that inspire or align with your family’s values. Choose a mix of beloved classics, stories of resilience, and tales that spark creativity. Personalizing each book with a special note or inscription adds a personal touch, creating a library that grows as they do.

How to Get Started: Start with a few meaningful books and add to the collection on birthdays and holidays. Make it even more memorable by including a bookshelf or bookcase dedicated to their collection. Don’t want to spend a lot of money? Used book sales at libraries, garage sales, and online shops like Thrift Books or Ebay, can help you stay on a budget!

3. Lessons in a Skill or Hobby

Rather than a toy that may only provide short-term fun, gift your child lessons in something that could shape their interests and skills, like music, art, or a sport. These activities not only build confidence but also foster perseverance, teamwork, and discipline. A commitment to skill-building gives your child an experience they’ll carry with them for life.

How to Get Started: Research local classes or online lessons in an area that interests them. Some places to start are Skillshare.com, your local community college (online or in-person), or on websites like ExperienceGifts.com. Present it as a certificate or “voucher,” and consider joining them for a session or two to encourage their enthusiasm.

4. Memory Journal or Scrapbook Kit

Gift your child a way to preserve memories by creating a journal or scrapbook where they can document special moments each year. It’s a meaningful keepsake that becomes more valuable over time, as they fill it with photos, drawings, and stories from their life. Plus, they can look back on it with a sense of pride and nostalgia.

How to Get Started: Include supplies like colored pens, stickers, and printed photos from your local craft store or Dollar Tree. Set aside time each month to help them add memories (make sure you add the event to your calendar), making it a tradition you enjoy together all year long.

5. Family Travel Fund

Instead of traditional gifts, start a family travel fund that grows with each contribution. Involving kids in planning and saving for trips gives them a sense of ownership and anticipation. Each new destination becomes a family memory that far outlasts the latest gadget.

How to Get Started: Create a special jar or account labeled “Family Travel Fund” and set a goal for a specific trip. Include your child in researching the destination, budgeting, and planning activities, making the trip as memorable as the gift itself.

6. A Time Capsule

Creating a time capsule together can be a fun and meaningful way to preserve your gift for the future. Include items that capture your child’s current interests, a letter from you, and other memorable keepsakes. Set a date in the future for opening the capsule—such as a milestone birthday or graduation—giving them a cherished look back at their early years.

How to Get Started: Use a sturdy box and gather items like family photos, small toys, a letter, and a note with the date and year. Label it with the “open on” date and store it somewhere safe until the big day. Make sure to work together with your child to add things that they think are important to remember in the years to come. Write a notecard of their reasonings of importance and include it in your time capsule.

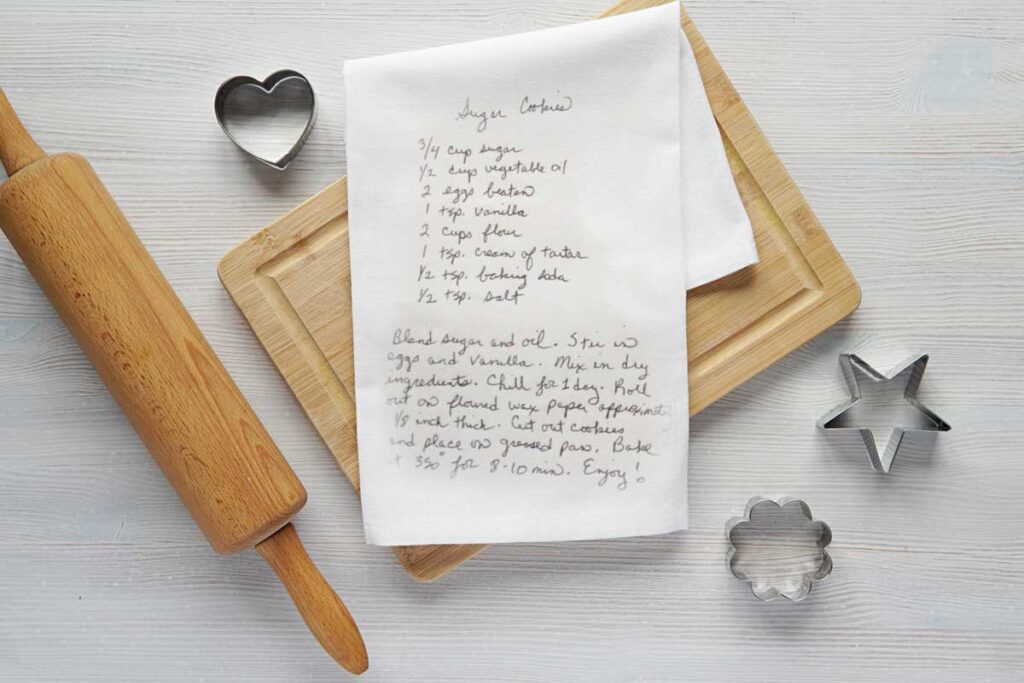

7. Family Recipe Book

Pass down family traditions with a recipe book that includes favorite dishes, secret ingredients, and stories behind each recipe. This is a gift that not only preserves family heritage but also gives your child a taste of home wherever life may take them. It’s an ideal keepsake for a future chef or food lover.

How to Get Started: Begin by documenting family recipes with photos and notes. Make sure to not only include your famous recipes, but reach out to grandparents, aunts/uncles, and other family members. Involve your child in cooking these meals together, adding their own notes to the recipes. Over time, it’ll become a cherished family heirloom.

Why Choose Gifts That Last?

Gifts like contributing to an Edvest 529 College Savings Plan account, a family travel fund, or a memory scrapbook can provide more than temporary excitement—they can offer security, cherished memories, and valuable skills. This holiday season, consider gifts that support their dreams, honor your family traditions, and show your commitment to a future.

To learn more about Wisconsin’s Edvest 529 College Savings Plan, its investment objectives, risks, charges, and expenses, see the Plan Description at Edvest.com before investing. Read it carefully. Investments in the Plan are neither insured nor guaranteed and there is the risk of investment loss. Consult your legal or tax professional for tax advice. If the funds aren’t used for qualified higher education expenses, a federal 10% penalty tax on earnings (as well as federal and state income taxes) may apply. Prior to investing, check with your home state to learn if it offers tax or other benefits such as financial aid, scholarship funds or protection from creditors for investing in its own 529 plan. TIAA-CREF Individual & Institutional Services, LLC, Member FINRA, distributor and underwriter for Wisconsin’s Edvest 529 College Savings Plan.

Ugift is a registered service mark of Ascensus Broker Dealer Services, LLC.

Neither TIAA-CREF Tuition Financing, Inc., nor its affiliates, are responsible for the content found on any external website links contained herein.

4003322-1127